May 18, 2018

Why your car insurance rate changes

If you've ever opened an insurance renewal letter and been surprised or confused—we understand. We've all been there, too.

Knowing the most common reasons why your car insurance rate fluctuates can help you prepare.

Why did my insurance go up?

Some of the changes you make in your life can affect the price you pay for car insurance.

You move. Where you live is a pretty good indicator of where you drive, and certain areas present more risk than others. If you move to a place where only a few people get into accidents and not many cars are stolen, there’s a good chance your car insurance rate will go down (assuming everything else in your life stays the same). On the other hand, if you move to an area with more car accidents, you’ll generally pay a higher rate. If you move to a different state, that's harder to predict. Each state regulates insurance differently, and the difference in cost can vary widely.

Your driving record changes. At Root Insurance, your driving score is the No. 1 factor in the price you pay for car insurance, but your driving history also plays a role in your rate.* If you’re in an accident or get a few speeding tickets in a short period of time, that will affect your rate.

The good news is that bad driving incidents disappear from driving records after 3-5 years. When that happens, your insurance rate will likely change again for the better.

If you’re shopping around for a new car, remember that our Root app makes it easy to check—in real time—how your rate would be affected by changing vehicles.

You add, remove, or change a vehicle on your policy. Generally, it costs more to replace a Ferrari than a Ford. The cost of repairing or replacing different vehicles varies. When you change the vehicle lineup on your policy, the price of your insurance will almost certainly be affected.

You change the drivers on your policy. The more people on your policy, the more money you’ll pay to cover everyone.

It’s important to keep in mind that the other people on your policy can affect your rate in other ways, too. For example, if you drove perfectly this policy term, but your 16-year-old got two speeding tickets, your renewal rate will probably change.

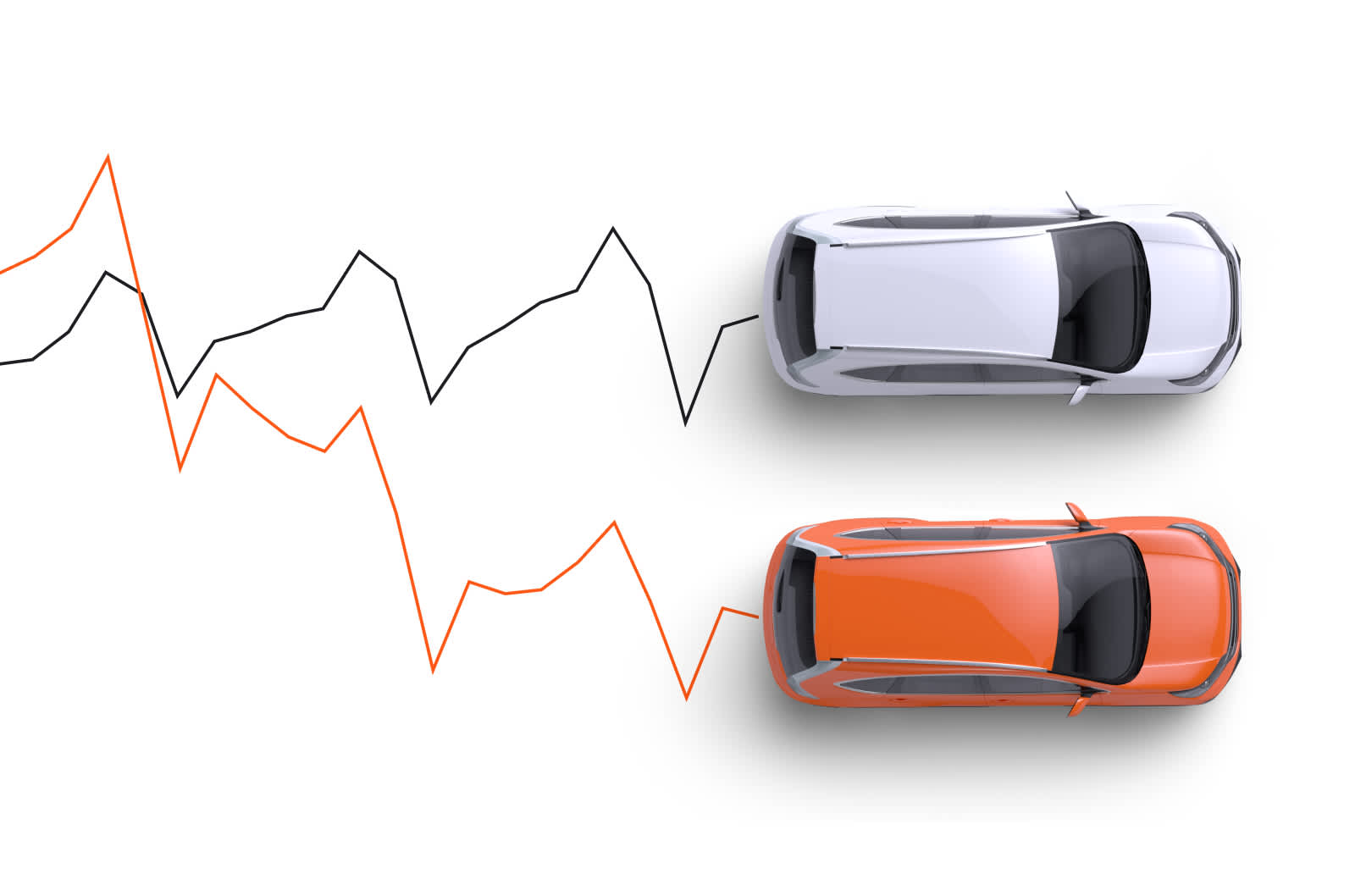

Your car insurance rate vs. the world

When the world around us changes, those changes can have a significant effect on car insurance rates.

The amount of accidents around you goes up or down. Even if you’re the best driver in the world, someone can crash into you. Even if you’re extremely careful, someone could steal your car. If the rates for accidents and theft go up or down in your area, your insurance rates will follow.

The weather around you changes. Is your state experiencing an unusually heavy storm or fire season? Are scientists predicting an earthquake? Weather and natural disaster risk changes with time. If your insurance company anticipates paying for increased flood damage in your area in the near future, your rates will go up.

The cars around you get more or less expensive to repair. Depending on where you live, you might notice an increase in electric cars and cars with autonomous technology. While having safer, energy-efficient cars on the road is a good thing, unfortunately, those cars are generally more expensive to repair—and the added expense can affect your insurance rate. On the other hand, some cars get less expensive to repair as time goes on and the technology to fix them gets better. This could lower insurance costs where you live.

Reasons your car insurance rate could fluctuate with Root

Running an insurance company sustainably is challenging. Insurance companies must charge enough for policies to cover the cost of claims and running a business, without setting prices too high.

At Root, fairness is also a crucial part of that equation—the best rates for the best drivers. We’re committed to giving our good drivers the lowest rates possible.

But to do that well—and in a way that keeps us healthy as a company—we have to keep a sharp eye on our data and how our models perform over time. Our actuaries are knee-deep in the numbers every day, doing the tricky insurance calculations—creating, checking, and double-checking our actuarial tables.

Those tables are really just predictions of how many claims we’ll pay in a given amount of time. We constantly monitor them to ensure they’re accurate. If we see areas where a prediction doesn’t quite align with reality, we act. If it looks like we priced too high in certain areas, we lower prices. If it’s clear we’re underpricing, we adjust prices upward. Although this is a normal and ever-present part of insurance, it does affect your rate.

Insurance risk is a constantly evolving calculation with many factors, which is why rates are never permanent. Your rate will fluctuate for as long as you have insurance. Those fluctuations can be big or small.

Our promise to you:

We are 100% committed to bringing you the fairest rates possible.

Root was founded on fairness. We use the best technology and data available every day to make both our insurance coverages and prices the best in the industry, and we will stop at nothing to ensure our rates are the most accurate in the business.

So, when your rate raises or lowers, you can be confident we are working the calculations and always doing our utmost to get you the lowest price we can sustainably offer, while being responsible as a company.

*Test drive may not be available for policies purchased through an agent.

Related Posts

February 28, 2019

Top 3 questions about Root’s test drive

At Root Insurance, your car insurance rate is based primarily on how well you drive. Really. The better you drive, the more you could save. Read more

May 02, 2018

How to choose Liability, Bodily Injury and Property Damage coverages

Learn the basics of Liability, Bodily Injury and Property Damage coverage so you can select the right level of coverage for you. Read more

October 06, 2017

How Root prices car insurance fairly

You might already know we offer a different kind of car insurance experience—based entirely within our app—and that good drivers could save hundreds annually. But how does Root Insurance pricing work differently, too? Read more